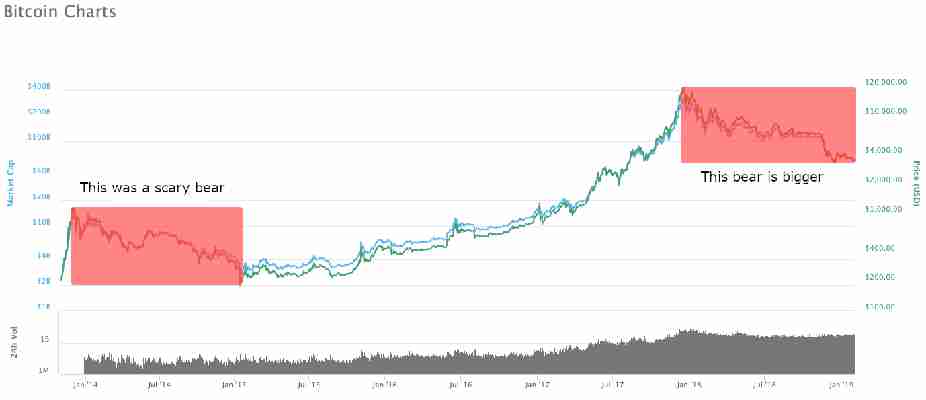

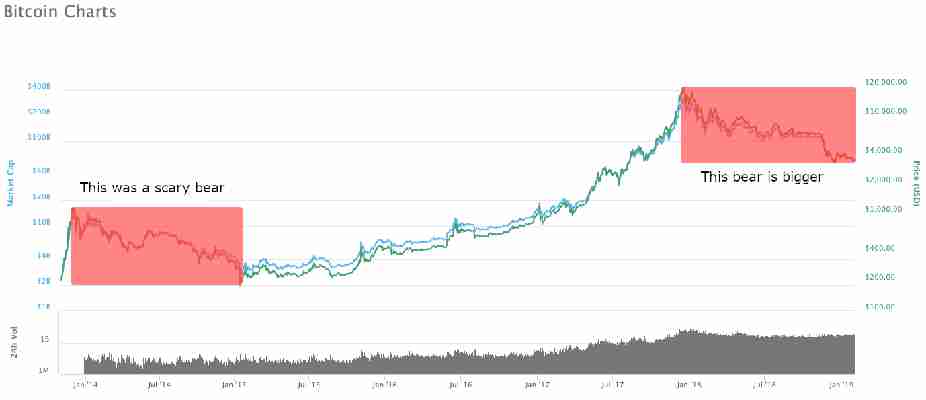

You are in the most intense Crypto Winter ever felt.

By the end of today, we will have survived more straight days (411) of falling Bitcoin value than at any other point in its 10-year history .

The previous record for downward price movement in cryptocurrency was the stretch between November’s end 2013 and mid-January 2015, when Bitcoin‘s price fell from $1,100 to just $200.

For reference, the price of Bitcoin peaked halfway through December 2017, when it briefly soared past $19,000. It has been dropping ever since.

Congratulations – you’re still here

This bear market has caused so many casualties . Blockchain startups like ConsenSys, STEEM, Ethereum Classic, and most recently NEM , have all used the Bitcoin bear/boogeyman to explain away their failure to make necessary return on investment.

The thing is, nobody knows how long this nightmare will continue, although there have been some estimated guesses.

One group of cryptocurrency analysts studied how often Bitcoins are moved, and concluded we are most probably in the final phase of the bear market .

This means we could soon enter a long accumulation period (where Bitcoin bulls start to collect as much Bitcoin as possible.)

Goddamn, they had better be right.

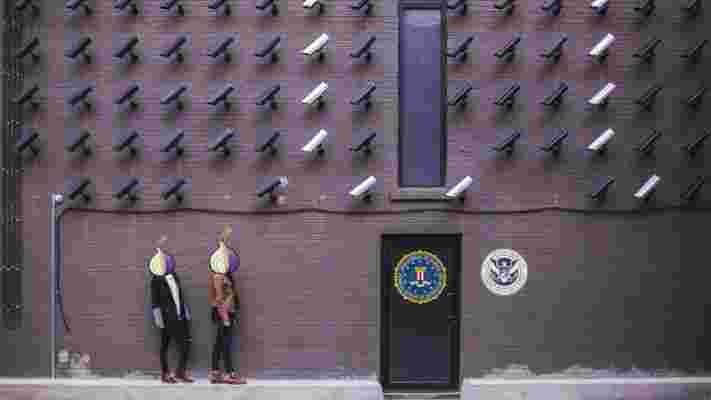

FBI seizes $4.5M in cryptocurrency in dark web drug bust

Yesterday, the Federal Bureau of Investigation (FBI) announced the results of its latest dark web investigation which saw over $4 million worth of cryptocurrency seized from criminals.

Led by members of the Joint Criminal Opioid and Darknet Enforcement (J-CODE) team, Operation SaboTor resulted in 61 arrests and the shutdown of 50 dark web accounts associated with online criminal activity.

The operation also confiscated nearly 300 kilos of drugs, 51 firearms, and more than $4.5 million worth of cryptocurrency, $2.48 million in cash, and $40,000 worth of gold.

What cryptocurrencies were seized has not been disclosed.

Operation SaboTor ran from January 11 to March 12 this year, involving a series of operations all targeting “the opioid epidemic.” The investigation went after the most prolific opioid vendors on the dark web to takedown their operations and bring their trading to an end.

Law enforcement agencies, including the Drug Enforcement Administration (DEA), US Immigration and Customs Enforcement Homeland Security Investigations (HSI), US Customs and Border Protection (CBP), teamed up with the FBI to carry out the operation.

“Law enforcement is most effective when we work together, and J-CODE is the global tip of the spear in the fight against online opioid trafficking,” FBI Director Christopher Wray said in the announcement. “Criminals have always adopted innovations and new technologies to achieve their illicit goals, and it’s our job to adapt and remain ahead of the threat.”

Indeed, with operations like SaboTor it’s going to get increasingly difficult for criminals to carry out their illicit activities on the dark web as the law enforcers get more adept at policing new technologies.

“The [dark web] is not as dark as you think. When you buy or sell illegal goods online, you are not hidden from law enforcement and you are putting yourself in danger,” Catherine De Bolle, Europol Executive Director, also said in the announcement.

Considering that the US government is trying to deanonymize cryptocurrency , and new EU regulations are making it even harder to obscure your identity when buying Bitcoin online, De Bolle’s statement is certainly ringing true.

But that name, SaboTor, a portmanteu of saboteur/sabotage and the dark web browser The Onion Router (TOR); bravo to whoever came up with that.

Did you know? Hard Fork has its own stage at TNW2019 , our tech conference in Amsterdam. Check it out .

SEC chairman explains how it classifies cryptocurrencies as securities

Consider it confirmed: the Howey test is definitely the US Securities and Exchange Commission‘s (SECs) gold standard benchmark for deciding whether a cryptocurrency is in fact, a security.

“Security” is a term used for describing certain financial assets that can be traded. It can refer to any form of financial instrument, even cryptocurrencies and associated tokens.

Chairman Jay Clayton finally responded to calls to clarify how the SEC approaches classifying cryptocurrencies as securities. A set of political representatives formally submitted concerns a few months back, which were supported by digital asset think-tank Coin Center .

His reply outlines the SECs stance clearly: the Howey test is its “litmus test” for detecting securities within the blockchain industry, and it’s entirely possible for digital assets once classified as securities to shed that definition altogether.

This was enough for Coin Center to declare this a reinforcement of previous SEC statements, which deemed Ethereum (currently) too decentralized to be a security .

“This letter is another reference point for lawyers and developers to look to when determining how their project fits into current regulation,” Coin Center’s comms director Neeraj Agrawal told Hard Fork. “As far as reactions go: people welcome any clarity they can get.”

What constitutes a security in the context of cryptocurrency

The Howey test comes as a result of a legal battle from 1946 . It’s really a framework for determining whether a particular asset is considered to be an investment contract (security). It is commonly used to enforce federal securities law.

Clayton’s letter expressed that SEC regulators consider the “touchstone” of securities as “the presence of an investment in a common venture, premised on a reasonable expectation of profits to be derived from the entrepreneurial or managerial efforts of others.”

“Your letter also asks whether I agree with certain statements concerning digital tokens in Director Hinman’s June 2018 speech ,” wrote Clayton. “I agree that the analysis of whether a digital asset is offered or sold as a security is not static […].”

Whether a digital asset is considered a security depends on the circumstances and facts surrounding the original investment. Clayton gave an example: when investors (who have “pooled” assets to contribute to funding a project) no longer expect a dev (or group of devs) to carry out managerial or entrepreneurial efforts, their investment may no longer be considered a security.

“A digital asset may be offered and sold initially as a security because it meets the definition of an investment contract, but that designation may change over time if the digital asset later is offered and sold in such a way that it will no longer meet that definition,” he added.

The SEC is ‘policing these markets vigorously’

Clayton also took time to really hammer it home to entrepreneurs in the cryptocurrency space. He noted many stakeholders have engaged with SEC regulators “constructively” and in “good faith,” but others have been preying on the excitement of retail investors to commit fraud.

“The Division of Enforcement has brought a number of important cases in this area, and I have asked the Division’s leadership to continue to police these markets vigorously and recommend enforcement actions against those who conduct ICOs or engage in other actions relating to digital assets in violation of the federal securities laws,” he warned.

Likely, Clayton is referring to a sudden string of settlements with fraudulent projects. In particular, Floyd Mayweather and DJ Khaled were forced to pay a combined $750,000 for failing to disclose endorsement deals with the CentraTech cryptocurrency.

Around the same time, SEC authorities charged the founder of “decentralized” digital asset exchange EtherDelta with running an unregistered national securities exchange. He agreed to pay $300,000 in fines and penalties.

“The Commission acted swiftly to crack down on allegedly fraudulent activity in this space, particularly where the misconduct has targeted Main Street investors,” boasted Clayton. “Regardless of the promise of distributed ledger technology, those who invest their hard-earned money in opportunities that fall within the scope of the federal securities laws deserve the full protections afforded under those laws.”

For the full letter, click here . For a breakdown of how cryptocurrency’s asset classification can change over time, click here .

Did you know? Hard Fork has its own stage at TNW2019 , our tech conference in Amsterdam. Check it out .