As the coronavirus pandemic hit the financial markets, the MAGAs and FAANGs of this world — acronyms for the largest tech companies — have been presenting themselves more and more as the new blue-chip stocks. While most public companies are still deep in the red, they’ve been able to rebound, with some of them even nearing all-time highs again.

It shows that the digital economy is more important than ever. But while these juggernauts are absorbing most of the investment savvy people and financial media’s attention, there’s an undercurrent of tech companies that aren’t worth a trillion dollars yet. And some of those companies’ revenues are accelerating much faster than those of the tech giants.

That’s because of their current size; they’re worth between $10 and $25 billion, which means they relatively have more room to grow. They’re much nearer the beginning stages of their development, and are much more focused on serving one particular, growing need.

So, which are these companies whose revenues are not only absolutely growing faster each year, but also percentage-wise? In other words, what are the tech companies that are relatively growing the quickest?

Before we reveal these three companies to you, do note that none of them are making a profit yet. They’re all heavily investing in their product and team, to facilitate further growth.

Zscaler (ZS)

Zscaler is a globally operating cloud security company worth $10B.

Zscaler has seen its annual revenue grow from $80M to $302M in the span of four years. Absolutely, they saw year-over-year growth — between each of those four years — of respectively $45M, $64M, and $113M in revenues. Going from $45M to $64M in annual revenue growth is a 42% acceleration. Going from $64M to $113M in annual revenue growth is a 75% acceleration. This means Zscaler has seen not just its revenue grow significantly, but also the acceleration of its growth.

DocuSign (DOCU)

DocuSign is also a cloud-based software company, and offers digital signature solutions to businesses worldwide, enabling digital agreements. It’s currently worth $23B.

DocuSign has seen its annual revenue grow from $381M to $974M in the span of four years. Absolutely, they saw year-over-year growth — between each of those four years — of respectively $137M, $182M, and $273M in revenues. Going from $137M to $182M in annual revenue growth is a 33% acceleration. Going from $182M to $273M in annual revenue growth is a 50% acceleration. This means DocuSign has also seen not just its revenue grow significantly, but also the acceleration of its growth. Slightly ‘slower’ than Zscaler, but still very impressive.

Cloudflare (NET)

Another cloud-based company, Cloudflare manages data centers around the world to improve its clients’ site performance and loading times, and provides defenses against cybersecurity threats. It’s currently worth $9B.

Cloudflare has seen its annual revenue grow from $85M to $287M in the span of four years. Absolutely, they saw year-over-year growth — between each of those four years — of respectively $50M, $58M, and $94M in revenues. Going from $50M to $58M in annual revenue growth is a 15% acceleration. Going from $58M to $94M in annual revenue growth is a 63% acceleration. Cloudflare’s yearly acceleration diverged a bit more than that of DocuSign, but on average has been almost on par.

Perhaps unsurprisingly , all of these three companies are business-facing, and they are all offering cloud solutions. They’re the so-called SaaS (software as a service) companies, and are helping the economy transition into an ever more digital one.

5 tips for an ethical investment in tech stocks

These days people trading on the stock market want more than just a strong financial return. They’re increasingly opting for investments that will also have a positive societal impact.

The coronavirus pandemic showed us even established tech companies can suffer downturns in the short term. Apple , a tech behemoth, was left reeling when Chinese manufacturing hubs were temporarily shut down last year.

In the longer term, however, technology stocks remain a first choice for many investors. Historically , they’ve dominated global stock markets and continue to grow at a remarkable rate.

Even during the downward spiral of the pandemic, tech stocks such as Zoom and Microsoft soared in value as an influx of people started working from home. The question for many investors now is: how can one find profitable investments without supporting unethical activity?

Growth of tech stocks

According to investment advisers Morningstar , technology stocks account for 24.2% of the top 500 stocks in the United States. Facebook, Apple, Amazon, Netflix, and Alphabet (which owns Google) dominate the market, with a combined value of more than US$4 trillion .

Tech stocks also take center stage in Australia. We’ve seen the rapid rise of “buy now, pay later” companies such as Australian-owned Afterpay and Zip.

At the same time, we’ve seen an increase in the number of Australians moving to ethical superannuation funds and ethically-managed investment schemes. The latter lets investors contribute money (to be managed by professional fund managers) which is pooled for investment to produce collective gain.

It’s estimated indirect investment through these schemes has increased by 79% over the past six years.

What is ethical investing?

While ethical investing is a broad concept, it can be understood simply as putting your money towards something that helps improve the world. This can range from companies that advocate for animal rights, to those aiming to limit the societal prevalence of gambling, alcohol, or tobacco.

Although there is no strict definition of ethical investment in Australia, many managed funds and super funds seek accreditation by the Responsible Investment Association Australasia . The “ethical” aspect can be grouped into three broad categories:

As investors, we must be very careful about the fine print of the companies we invest in. For example, accreditation guidelines dictate that a managed investment fund excluding companies with “significant” ties to fossil fuels could still include one that earns up to a certain amount of revenue from fossil fuels.

So while investment manager AMP Capital is accredited, it can still include companies earning up to 10% of their revenue from fossil fuel distribution and services.

5 tips for ethical tech investment

Many technology stocks are well-placed for ethical investment, and you can choose to invest on your own, or indirectly via a managed investment fund. In either case, you should do some basic homework first.

1) Monitor the fund or company to ensure standards are maintained

For a company to be listed with the Australian Securities Exchange (ASX) it has to be publicly listed. It is therefore required to submit an annual audit report (audited by third-party auditors) to the Australian Securities and Investments Commission (ASIC), as per the Corporations Act 2001 .

You can also contact ASIC for further information about a company listed on the ASX. The equivalent body for American companies is the US Securities and Exchange Commission .

If a company backtracks on the very ethical standards that prompted your initial investment, you should consider withdrawing your investment.

2) Stay updated on reported ethical breaches

Reputable news reports are useful on this front. Amazon, Facebook, and Alphabet are recurring names in reports about unethical practices in the tech sector.

While you can access plenty of information about a tech company from its own website and distribution channels, this is usually embellished and/or handpicked by the company itself. Make sure your information comes from diverse sources.

3) Consider how employees rate the company and why

Keep in mind a technology company might be environmentally ethical but still fall down on other issues, such as gender pay parity, for instance. It’s important to listen to employees’ claims about a company’s internal workings as such insight may otherwise be unavailable .

There are a number of independent sites reporting on corporate culture ratings, including Glassdoor .

4) Assess the environmental, social, and corporate governance (ESG) score

One benefit of investing in large to medium-sized tech companies is the ability to analyze their ESG score, issued by agencies such as Refinitiv . This score reflects how well the company adheres to ethical practice across environmental, social , and corporate governance-related matters.

5) Watch out for buzzwords

If you’re looking to invest in clean technology, watch out for buzzwords used in company reports. These are terms which at face value may seem to align with your own ethical investment values, without actually delivering.

For instance, “carbon net zero” and “carbon neutral” are not the same thing . This is an important distinction to consider if you’re wanting to make environmentally-responsible investments.

This article by Angel Zhong , Senior Lecturer in Finance, RMIT University and Banita Bissoondoyal-Bheenick , Associate Professor and Associate Dean Finance, RMIT University is republished from The Conversation under a Creative Commons license. Read the original article .

Bitcoin mining is sucking Georgia’s power grid dry — but it doesn’t matter

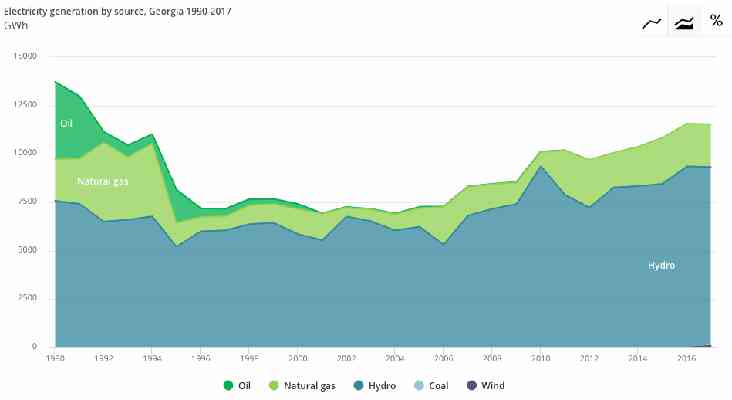

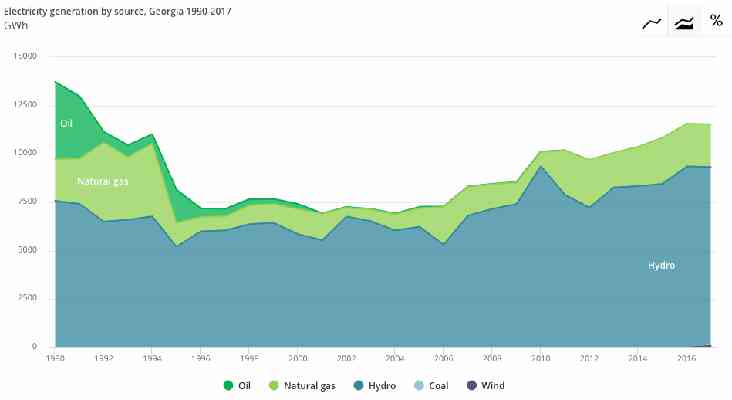

Bitcoin mining in the Eurasian country of Georgia is reportedly “sucking its power grid dry,” but it doesn’t matter because the country has reserves of hydroelectric power.

According to BBC Sounds podcast, Business Daily , Georgia is now the world’s third largest miner of Bitcoin, behind China and Venezuela.

However, it’s not good news for some. David Chapashvili from Green Energy, an environmental pressure group, criticizes the practice for how much electricity it consumes.

Bitcoin mining is Guzzling up electricity

Documents shown to Business Daily by the environmental group report that one Bitfury-owned Bitcoin mining farm is “guzzling” up 4 percent of the country’s electricity. That’s more than 389 million kilowatt hours in raw numbers.

But this is just one factory. Chapashvili says the country actually has no understanding of the total impact cryptocurrency mining is having on Georgia’s energy consumption.

“There are lots of micro-miners,” he said. “If you ask a very simple question to the ministry like which sector is consuming [energy] Georgia doesn’t have this kind of analysis.”

“Actually, in reality we don’t know what’s going on or how many consumers are [mining Bitcoin],” Chapashvili added.

The environmental pressure group estimates that Bitcoin mining is using more than 10 percent of the country’s energy supplies.

However, representatives from Bitfury say its energy use isn’t much if you compare it to the energy required to mine conventional precious metal mining.

But it’s a kind of non-issue.

Most of Georgia is actually powered by renewable energy . According to statistics from the International Energy Agency (IEA), more than 80 percent of the country’s energy comes from hydro power.

There’s also an energy surplus in the country, so it could be argued that it doesn’t really matter hat Bitcoin mining uses so much of its power.

What’s more, according to government sustainable development group Invest In Georgia, the country is only exploiting 25 percent of its potential when it comes to renewable energy production.

Bitfury even says the presence of cryptocurrency miners in the country is actually driving support for renewable energy.

Placing mining centers next to hydroelectric plants to consume the surplus of renewable energy actually puts the power to good use. Meanwhile, the country can develop the infrastructure required to take advantage of it.

If anything, it’s a good thing that Bitcoin miners are utilizing the green, hydroelectric power. It’s turning what would be otherwise unused, surplus energy into a transferable store of value that can move around the world.

Bitcoin is often criticized for its energy use. The Bitcoin network’s total power consumption is often compared to that of entire countries, like Austria . The important question to ask though, is: Where does that energy come from?