Facebook Libra’s potential to help cryptocurrency go mainstream has been touted in recent weeks, but recent survey results indicate otherwise.

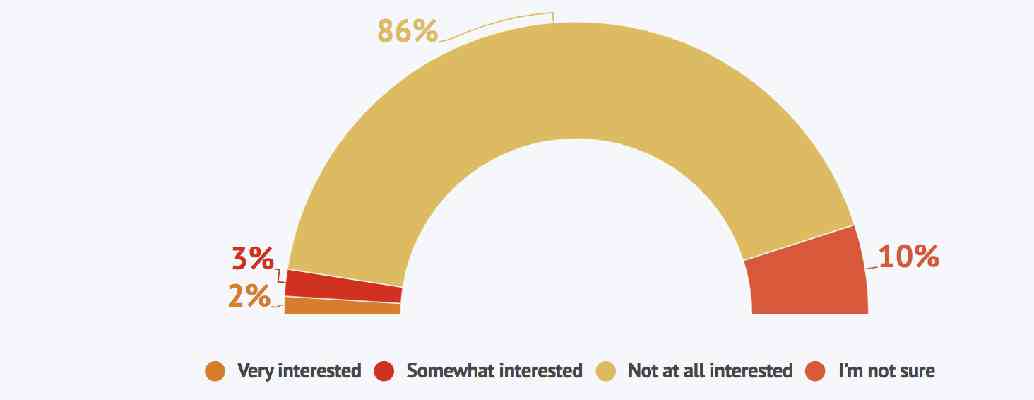

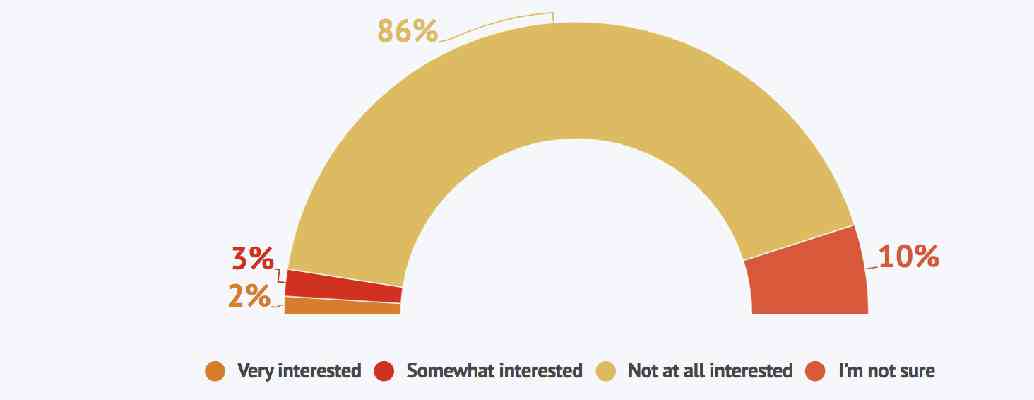

According to a poll conducted by CivicScience , which looked into general interest and public concerns surrounding Libra following the announcement of its launch, only five percent of 1,799 US adults surveyed expressed any level of interest in the proposed digital currency.

In stark contrast, an overwhelming 86 percent said they were ‘not at all interested,’ while 10 percent seemed unsure.

Unsurprisingly, those who said they were interested were younger, mostly belonging to the 18-to-24-year olds cohort.

Additionally, 77 percent said they didn’t trust the ‘Big F’ – and it’s hardly surprising given the company’s poor track record with data handling.

Some 21 percent of people said they trusted Facebook ‘a little,’ while only 2 percent said they trusted it ‘a lot.’

Libra vs Bitcoin

But, how does this compare with overall perception about Bitcoin?

According to the survey, only 40 percent of respondents said they trusted Libra less than Bitcoin and other cryptocurrencies, with the majority of people trusting it “much less.”

Only a mere 2 percent said they trusted it more, while almost 20 percent said they trusted Libra ‘about the same.’ The remainder of respondents were uncertain.

The research also points out that, although less than 10 percent of respondents have invested in cryptocurrency, a significant percentage feel less trusting of Libra than of Bitcoin or other digital currencies.

Let’s be real, Bitcoin and its fellow cryptocurrencies have a long way to go if they’re ever to hit the mainstream, but it looks like Facebook may be up a bigger challenge than it’d hoped.

Mark Zuckerberg may have a vast user base at his fingertips, but will Libra be the most loved cryptocurrency of them all? I sure hope not.

Bitcoin dominance exceeds 70% for the first time since March 2017 — but that doesn’t mean shit

Bitcoin‘s market capitalization has exceeded 70 percent of the total cryptocurrency market for the first time since March 2017 — when it was worth just $1,000 per coin .

This metric is commonly referred to as its “dominance.” It’s a rather simple estimate that’s typically used to show how popular investing in that particular currency is.

To determine the market capitalization of any particular digital asset, simply take its price and multiply it by the number of tokens in circulation (Note: circulating supply and total supply often differ).

For example, if there are 100,000 Buttcoins in circulation, and they’re worth $10 each, the total market capitalization for Buttcoins would be $1,000,000.

OK, market caps and Bitcoin dominance aren’t great metrics

The thing is, market dominance and market capitalizations are far from perfect metrics. While they do provide an easy and quick overview of a particular cryptocurrency and its related market, they do nothing to represent liquidity.

For instance, one may be able to sell 100 Dogecoins for the current market price of $0.002580, but selling 1,000,000 Dogecoins for that amount would be a lot more difficult.

In that situation, the first few thousand Dogecoins could probably be sold for the current market price, but securing that price for the full million Dogecoins is unlikely.

So, how much are those 1,000,000 Dogecoins really worth? What about the total value of all circulating Dogecoins? Again, it depends on market liquidity, which is significantly more difficult to gauge.

There are alternatives to market caps that make more sense

This isn’t a secret among industry insiders. In fact, there’s been repeated attempts to determine more useful metrics to map the cryptocurrency market.

One interesting solution is research firm Messari’s ‘ liquid market cap ,’ which excludes stablecoins from the total cryptocurrency market capitalization, and makes other considerations, like accounting for the notorious “ Tether premium .”

Still, there’s no harm in using Bitcoin dominance as a rough guide for market sentiment, which indeed seems to be heavily in favor of Bitcoin over anything else.

For more Bitcoin market stats automatically generated every single day , be on the lookout for articles posted by our in-house robot, Satoshi Nakaboto. You can find an archive of its posts here .

Bank of Ireland staff asked to testify in $300M OneCoin fraud case

As the multi-billion dollar OneCoin cryptocurrency pyramid scheme continues to tumble, news of witnesses set to testify against the scam’s perpetrators are now coming to light.

According to Finance Feeds , employees of the Bank of Ireland have been asked to testify in the case against Mark Scott, one of the alleged figureheads of the $3 billion-plus OneCoin scam.

Scott, a former partner with international law firm Locke Lord, has been accused of laundering $300 million in OneCoin proceeds using corporate accounts at the Bank of Ireland. It’s believed that he misrepresented the source of the funds to the bank.

Three witnesses from the bank are being called upon. The first is Deidre Ceannt who worked in foreign direct investment between 2014 and 2017. The second is Derek Collins who was executive vice president and relationship director in 2016. The third and final witness is Gregg Begley who is said to have processed paperwork submitted by Scott.

The defendant allegedly setup a series of offshore investment funds, called the “Fenero Funds,” which were purportedly used to launder the illicit proceeds.

Based on the accusations, it appears that Scott used the offshore funds to disguise the fact that the money held in them was derived from the bogus OneCoin Ponzi scheme. It’s believed $300 million was moved from these funds into accounts operated by Bank of Ireland.

Despite the mounting evidence against Scott, he has previously denied that he knew OneCoin’s activities were unlawful. His trial was recently rescheduled to begin on November 4, 2019 .

If you weren’t in the loop on this whole OneCoin scam, you should probably get up-to-speed.

The OneCoin scam was headed by Bulgarian brother-sister duo, Konstantin Ignatov and Ruja Ignatova . At glamorous events, the pair promised to be launching a cryptocurrency unlike any other. Only, it was all fake , there was no blockchain and there was no cryptocurrency.

It’s one of the biggest cryptocurrency scams to have ever operated. The total figure of how much the duo managed to steal isn’t exactly known, however estimates suggest it’s at least $3 billion .

Want more Hard Fork? Join us in Amsterdam on October 15-17 to discuss blockchain and cryptocurrency with leading experts.