Slack stock closed at a fresh all-time high on Monday as traders continued to buy ahead of cloud kingpin Salesforce‘s rumored acquisition .

Wind of the deal has now boosted Slack‘s share price more than 45% in just three days of trade.

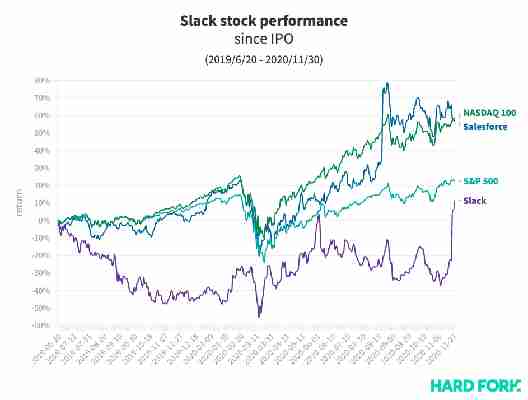

Slack stock even set a new record intraday high of $43.69 early Tuesday morning; in the green over 90% year-to-date, but only up roughly 12% since its IPO in June 2019.

Its previous intraday and closing records were $42 (June 20, 2019) and $40.70 (November 25, 2020).

That’s far behind benchmark indices like the S&P 500 and the NASDAQ 100, which have returned 22% and 59% since Slack‘s initial New York Stock Exchange listing.

But what’s been a stellar year for ‘stay-at-home’ tech stocks like Zoom and Amazon hasn’t converted quite so well for workplace comms darling Slack.

In September, the company’s stock fell up to 20% after posting earnings that showed quarterly revenues growing 50% year-on-year — which sounds great but pales in comparison to Zoom’s revenue, which reportedly jumped 355% throughout the pandemic.

On the other hand, traders pumped Salesforce stock nearly 30% after it posted healthy revenue growth in August. However, the company’s share price has fallen a few points since the Slack rumors began.

The market waits for more details on Salesforce’s Slack buyout

There’s currently no word on how much Salesforce is prepared to pay for Slack. CNBC cited sources familiar with the matter who said the deal could value Slack at a premium, and might be made half in cash and half in stock.

Slack‘s market value is now a touch under $25 billion. If Salesforce is willing to pay more, it could push the company’s stock price higher.

But, the opposite could occur if traders have already ‘priced in’ Salesforce’s potential valuation, considering its share price has already risen 45% in the past few days.

Analysts say Salesforce’s acquisition of Slack would help the San Francisco SaaS-lord reimagine itself as a hip, young, and relevant brand for tech-savvy workplaces.

More details are expected to drop after Tuesday’s trading session has ended.

Tesla becomes America’s first $100B publicly listed carmaker

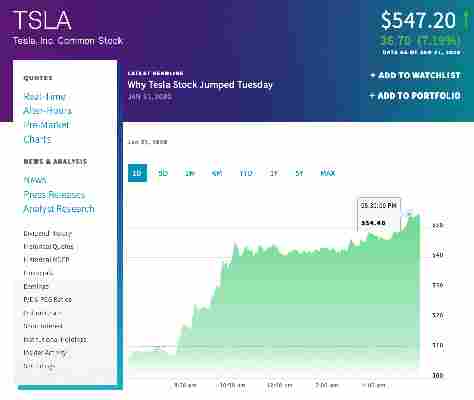

Elon Musk appears to have built a venerable financial fortress around his electric vehicle company Tesla. On Tuesday it became the first US carmaker, that publicly sells shares, to be valued at over $100 billion.

Late last night, at around 2330 CET (1730 EST) Tesla‘s share price jumped to $554 . This bumped the company’s overall market capitalization to over $100 billion.

Tesla‘s valuation far outranks other publicly traded US carmakers like General Motors and Ford. At the time of writing, General Motors market cap is around $49 billion, while Ford’s is just over $36 billion.

According to Reuters , the EV maker’s valuation is a sign of Wall Street‘s strong confidence in an all-electric future.

Tesla safety concerns

Over the past week, Tesla vehicles have been at the center of a petition to the US National Highway Traffic Safety Administration (NHTSA). The petition outlined a number of complaints — from both Tesla drivers and non-Tesla drivers — that the cars had been accelerating without warning or driver input.

What’s perhaps most significant is the petition was lodged by someone known for their bearish stance on Tesla. They are also known to bet against and short sell the company‘s stock.

The EV marque came out in force earlier this week contesting the petition saying that all of its vehicles accelerate exactly as they are designed to, and only when the driver asks it to.

The NHTSA highlighted that it receives numerous complaints of sudden unintended acceleration, and more often than not they were the result of driver error and not a problem with the vehicle.

At pixel time Tesla’s stock price sits at $547.20 where it closed the previous day.

Even though the debacle captured headlines, it evidently had no impact on Tesla‘s stock price in the short term. It seems nothing can derail the Tesla train.

Coinbase’s bet on Amber Group pays off as it hits a $1B valuation

Cryptocurrency trading firm Amber Group has reached unicorn status with its latest funding round of $100 million today. The Hong Kong-based firm raised money in the Series B round led by China Renaissance.

Other firms contributing to the $100 million sum included some prominent names, such as Tiger Brokers, Tiger Global Management, Arena Holdings, Tru Arrow Partners, Sky9 Capital, DCM Ventures, and Gobi Partners.

The company — backed by Coinbase in Series A investment round — caters to both individual and institutional cryptocurrency investors. However, its primary focus is to engage with wealthy investors with an aim to provide a “private banking experience to the everyday customer.” Some of its leading products are algorithmic trading, electronic market-making, and high-frequency trading.

In a press release, the company’s CEO, Michael Wu, said that its “ trading volumes have doubled from $250 billion since the beginning of the year to over $500 billion.” He added that the firm has been profitable since its inception, and is on track to register $500 million in revenue by the end of the year.

Cryptocurrency exchanges and service providers are in high demand in the venture capital world. According to data by Pitchbook, investors have poured in $14 billion into such firms in the second quarter of 2021. With Coinbase IPO in April, and firms reaching unicorn status, there could be more mega investments in the cryptocurrency world.