The ‘USD-backed’ cryptocurrency Tether (USDT) is struck with another market manipulation controversy.

A Bloomberg report published today suggests the possibility of wash trading of Tether on cryptocurrency exchange desk Kraken. The study found frequent repetitions of oddly specific orders, going into five decimal points. — highlighting the possibility of bot trading.

Bloomberg pulled data of 56,000 Tether trades from Kraken’s public order book that happened between May 1 and June 22. The research found the cryptocurrency’s trading on the exchange desk to be defying the principles of economics.

While most cryptocurrencies and other securities see fluctuations in price based on large buy or sell orders placed on exchange desks, it doesn’t seem to hold true for Tether.

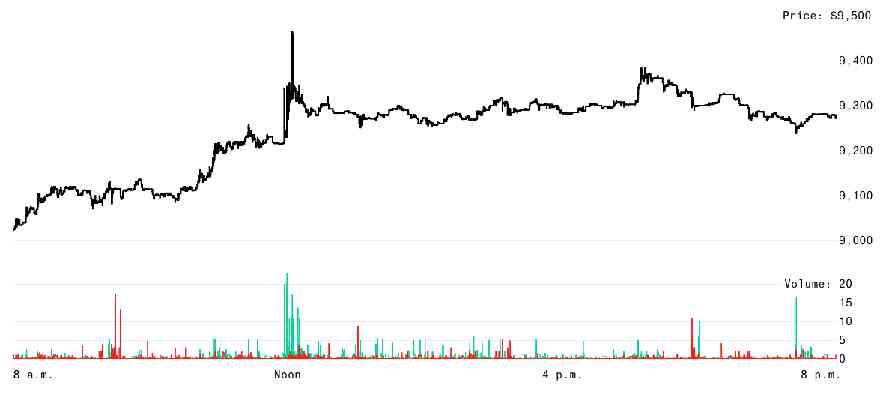

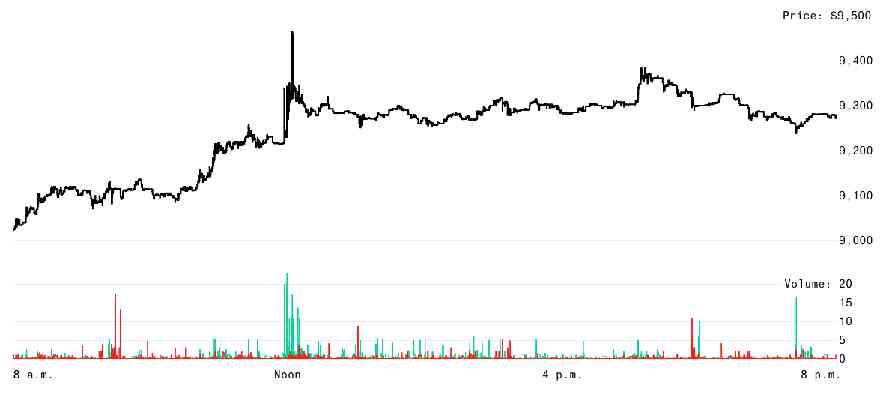

The study compared the fluctuations in the price of Bitcoin and Tether on a specific date and time to find that Tether is reacting inconsistently to demand and supply unlike Bitcoin, which moves in tandem with trading volume.

The chart for Tether doesn’t show consistent change in price based on the size of the buy or sell order placed:

The study found that trade orders were being placed frequently for very oddly specific numbers. ‘13,076.389’ USDT, for example, is the third most commonly traded amount next only to 75 and 1,000 USDT. Other frequent orders placed for USDT on the exchange are also oddly specific. The researchers conclude that these odd orders are being placed for the benefit of ‘automated trading programs,’ used to manipulate financial markets.

Bloomberg cites three different instances of Tether’s trade against the US dollar to point out the peculiarity.

On May 7, 31 consecutive buy orders were placed for Tether, but its price didn’t budge from $1.

On June 3, the price of Tether first rose by $0.0002 on a purchase of 37.5 USDT, but didn’t budge to another order of the same amount soon ofter. This was followed by one of the 13,076.389 USDT (the amount Bloomberg found was repeating itself oddly). But, despite being 349 times larger than the previous trade, it only led to a $0.0001 increase in Tether’s price.

On May 9, eight sell trades of the same 13,076.389 USDT occurred in succession over 16 seconds, but failed to bring nudge Tether’s price. The next trade for just 75 USDT however pushed the price up by 0.0001.

Bloomberg notes that Kraken’s involvement or knowledge of the suspected manipulation can’t be established. But Kraken management has refused to comment on the research findings.

Such market manipulation — known as ‘wash trading’ — is outlawed in traditional financial markets. But given the lack of regulations for cryptocurrencies, these phenomena remain unchecked.

However, reports in May suggested that the US Department of Justice is now probing cryptocurrency market manipulation.

It is worth noting that this is not the first time that Tether is facing allegations of market manipulation. Indeed, Tether is under investigations by the US authorities in another cryptocurrency market manipulation case along with cryptocurrency exchange desk Bitfinex.

Tether’s claim of being backed by the US dollar is also controversial .

Here’s how Bitcoin performed in Q1 2019

Bitcoin is the cryptocurrency that started it all, redefining the field of digital currencies. It was released by the pseudonymous Satoshi Nakamoto in their seminal white paper. The original idea was to create an online peer-to-peer cash that allowed users to exchange value online without being required to reveal their identity.

As it’s so commonly touted today, Bitcoin is decentralized. There are no central bodies to provide trust to transactions and ensure everything operates as it should. Instead, there is a globally distributed network of computers that validate and confirm transactions keeping an unchangeable list of transactions known as the blockchain.

Despite being the first of a whole swathe of cryptocurrencies, Bitcoin has always been able to weather the bear markets and maintain its position as the largest cryptocurrency by market capitalization.

Some of the most popular forks of Bitcoin include, Litecoin and Bitcoin Cash, but neither have come close to knocking Bitcoin off the top spot.

Despite its market dominance, Bitcoin has had its fair share of teething problems over the years. It’s been branded a “scam,” “ponzi scheme,” “a criminal’s tool,” and “the biggest bubble since the dotcom boom.” Various projects such as the Lightning Network seek to build on Bitcoin and fix some of its inherent issues like transaction speed and scalability.

For many years Bitcoin was understandably associated with criminal activity. However, as the years have progressed, and as Bitcoin gained more mainstream interest, it has begun to move away from this stigma.

In the last 18 months, Bitcoin is now also commonly seen in conversations alongside corporate and high street adoption, talk of use on Wall St, and as an investment class in its own right.

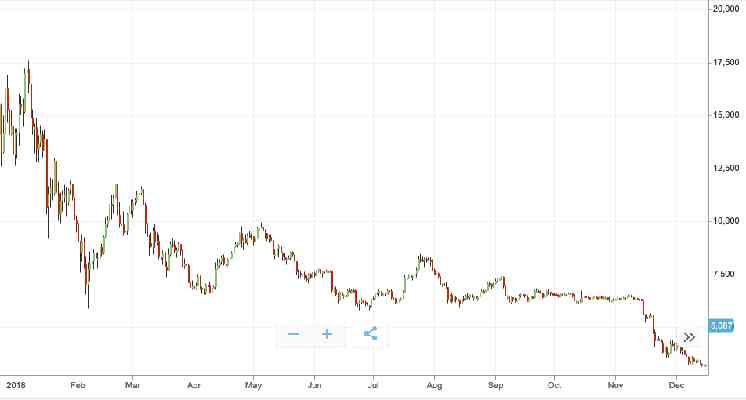

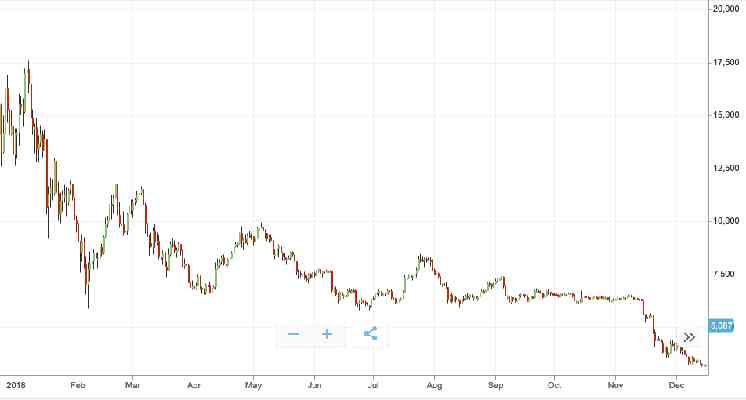

BTC/USD 2018 recap

Overall, last year was not a good year for Bitcoin. It got off to a solid start and continued the trend it saw for most of 2017. It bounced from $12,897 to $17,527 in the first week of the year. Sadly, it was all downhill from here, within a month Bitcoin had lost 60 percent of its value, dropping to $7,051 by February 6.

Bitcoin’s trading price was up and down for the rest of the year. There were a few brief rallies in the middle of the year but none were enough to lead to a consistent price rise. By end of the year, BTC was trading at $3,898, a 70-percent decline since the start of the year.

BTC/USD Q1 2019 review

Bitcoin, as with other cryptocurrencies, is often criticized for being highly volatile. However, in perhaps uncharacteristic form, Bitcoin has been relatively stable so far this year.

It opened the year at $3717.60 there was a brief increase in Bitcoin’s trading price grew 9 percent to $4031.09, in the first week of Q1. Price rallies are typical for the start of the year, but this was nothing particularly noteworthy by Bitcoin’s standards.

Unfortunately, this small jump was short-lived. Within a month, Bitcoin’s trading values dropped to a low of $3358.83 on February 7.

However, from here on in, things have looked strong and stable for Bitcoin. It experienced one notable drop at the end of February where its trading price fell 8 percent from $4106.24 – its highest price this quarter – to $3784.28 over a 24-hour period.

By the end of the quarter BTC had nearly equaled its quarter high and closed trading at $4092.71, a modest 10 percent growth for the quarter.

Bitcoin major events Q1 2019

The world’s leading cryptocurrency has had its ups and downs this quarter, though.

Many were expecting the SEC to finally make a decision on the VanEck and Bitwise Bitcoin Exchange Traded Funds (ETFs). However, the SEC has further delayed its decision pushing the possibility of Bitcoin on Wall St back to Q2, at the earliest.

Binance also launched a service which allows members of the public to buy Bitcoin at 1,300 different local newsagents across Australia.

Starbucks made headlines in March for providing coffee drinkers the opportunity to pay in cryptocurrency through the Bakkt platform. Starbucks itself isn’t letting its customers buy their coffees in cryptocurrency , Bakkt will convert cryptocurrency payments into fiat at the point of sale.

It might not be the realization of buying coffee with Bitcoin dream that we all hoped for, but it’s certainly a step in the right direction for making Bitcoin a common sight on the high street.

Back in January, Bitcoin analysts from Delphi Digital predicted that the Bitcoin bear market would be coming to an end this year. Predicting specifically, that Bitcoin’s price bottom would be found at some point in the first quarter of the year.

Looking forward into Q2

Given Bitcoin’s steady and stable performance since mid-February trading prices are looking strong for the cryptocurrency. It’s showing no signs of slowing in growth as it plows on into the rest of the year.

Already in Q2, Bitcoin’s price has rallied from $4092.71 to over $5100 in less than 3 days. If the those analysts are correct, Bitcoin may be setting itself up for its strongest quarter in over a year.

Dev sends Bitcoin without using the web or the power grid

One day we might all be able to send Bitcoin from literally anywhere in the world, with no electricity and no internet connection.

Off-grid cryptocurrency transactions seem to be becoming an achievable possibility as yet another developer has managed to send Bitcoin without a data connection, using low-cost consumer grade hardware.

An ingenious developer from New Zealand managed to send the transaction over 12 km away using four goTennas and a $30 Android smartphone.

For the uninitiated, goTennas are small devices that groups of adventurers use to stay connected to each other in areas with no cell reception. The devices pair with smartphones via bluetooth and send data to your fellow adventurers using radio frequencies.

The only issue is that goTennas work best in wide open areas.

How did he do it?

First, the antennas were placed about six kilometers apart on high ground to give the best connection possible.

Using the smartphone, he generated a signed Bitcoin transaction in Samourai wallet as a goTenna message.

The goTenna messaging service successfully delivered two signed Bitcoin transactions to dev’s girlfriend’s smartphone – also connected to the goTenna network.

The first transaction was sent from 5.6 km away and the second from 12.7 km away.

It might sound simple, but off-grid networks like this could have valuable future applications – particularly in times of natural disaster.

All the devices in this setup could be solar powered, so in theory this entire system could exist off-grid – at least in part.

Occasionally this off-grid network must sync with the Bitcoin blockchain to prevent double spending.

The real breakthrough here is this goTenna system is much simpler (and more accessible) than other powerless Bitcoin solutions created lately.

Last month devs released details of similar concept which used solar power, battery packs, and shortwave radios to perform off-grid, on-chain transactions .

But shortwave radios require more specialist knowledge than smartphones to operate, and in many countries you even need a license. A lot more equipment than four goTennas and a cheap smartphone.

Next time my family tell me to take a hike for talking about Bitcoin too much, my fun doesn’t need to stop!

Have you heard of Hard Fork Decentralized? Our three-day event centers around the future of blockchain and cryptocurrency. We’re currently offering an 85-percent discount on tickets. You might be eligible – check it out !