Microsoft’s bullish run has continued as the company entered the ultra-exclusive $2 trillion club. The company reached a $1 trillion market cap for the first time in 2019 — which means it took just two years to double that figure.

In the last quarter, the company posted a record revenue of $41.7 billion with 19% year-on-year growth. Its profit for that quarter was $15.5 billion — a 44% jump from 2020.

While most verticles from 2019, remain the same, the company’s cloud offerings have consistently shown tremendous expansion.

Apple is the only other publically traded American company with a market cap above $2 trillion. Saudi Arabian il company Saudi Aramco has previously passed this milestone, but its current valuation is under that mark.

As CNN noted, Microsoft share prices have climbed 64% since March 2020. That’s an indication of how the comapny’ s how the company’s products, including Teams, Office, Windows, and Azure cloud offerings have helped the world adapt to work-from-home culture during the pandemic.

Under Satya Nadella’s leadership, the company has thrived in the past few years. And that’s why he was also made the firm’s chairman last week .

This is a milestone for Microsoft just ahead of its June 24 event, where the company will unveil the next version of Windows — rumored to be named Windows 11. The company’s last major operating system update, Windows 10, was in released in 2015.

Dodgy Google Chrome extension reportedly causes $16K crypto theft

A malicious Google Chrome extension reportedly cost one user around $16,000 worth of cryptocurrency.

A bogus extension called “Ledger Secure,” that passes itself off as a cryptocurrency wallet, is believed to be responsible for the loss, Decrypt reports . The app allegedly sends a user‘s seed phrase back to its creators. With the seed phrase, bad actors can access another individual’s cryptocurrency illegitimately.

It should be noted that French company Ledger is not affiliated to the “Ledger Secure” extension.

In a tweet following the phishing scam, Ledger warned that “Ledger Secure” is not a legitimate application. It urged users to report the extension to encourage Google to remove it.

The affected Twitter user, now going by the handle “hackedzec”, claims the extension led to them losing 600 ZEC — about $16,000 at the time of writing.

The victim says they only entered their seed phrase into their computer once, about two years ago. They also say they photocopied their seed phrase using a WiFi-connected printer once as well. It’s difficult to say if these two instances were to blame. How the malicious extension got hold of their seed phrase is unclear.

The victim became aware of the shady extension after they reportedly found a file on their computer that linked to a Twitter account for the fake “Ledger Secure” extension. The Twitter account appears to pass itself off as a legitimate Ledger account.

It seems Google is still a bit hit-and-miss when it comes to removing illicit cryptocurrency apps from its Play Store and browser extensions.

This news comes in the same week that MetaMask was removed from — and swiftly reinstated to — Google’s Play Store after thinking it was a cryptocurrency mining app.

Bitcoin’s cumulative transaction fees surpass $1B milestone

It was going to happen sooner or later, but over the past few days cumulative Bitcoin transaction fees have surpassed the $1 billion milestone.

Data gathered by Hard Fork from financial and economic data site Quandl , shows the $1 billion mark was passed late last week, on October 11.

While it’s not necessarily the most significant statistic , it’s certainly an indicator of Bitcoin‘s continued use over time. Big upswings in fees can indicated big upswings in network use and competition to have transactions mined.

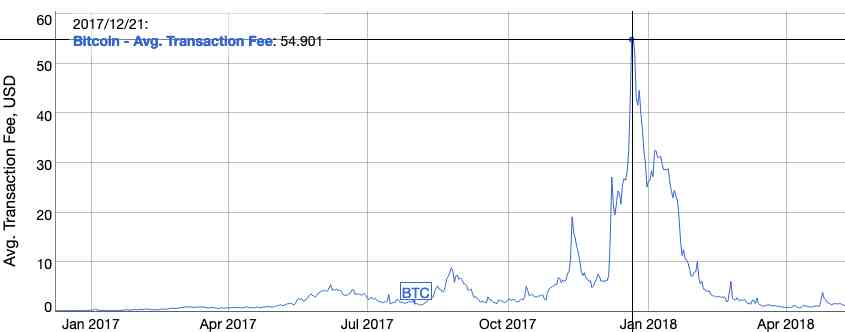

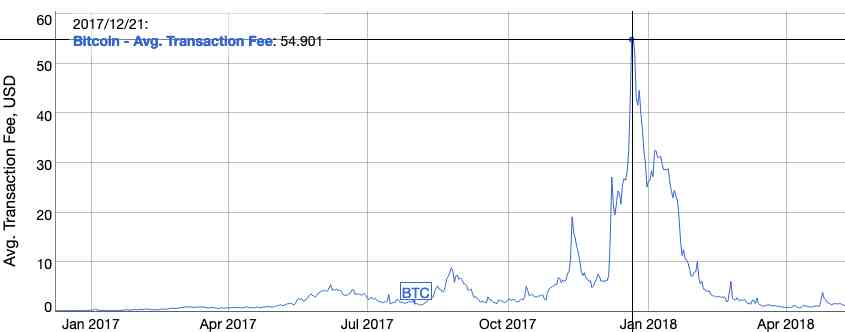

Bitcoin fees vary based on the overall use of the network. As a general rule, the more the network is used, the greater the fees will become. As network use decreases, so do transaction fees.

The fastest period of growth toward the $1 billion milestone was during the infamous 2017-2018 winter bull run.

In December 2017, average Bitcoin transaction fees increased to nearly $55, according to BitInfoCharts . This is a stark comparison to the past four weeks, which have seen an average transaction fee of somewhere around $1.

Indeed, given that Bitcoin is seeing continued interest from investors , the $1 Billion mark was always going to be reached at some point. How this will continue into the future of Bitcoin remains to be seen, though.

It should be kept in mind that as we get closer to the 21 million Bitcoin supply limit , mining rewards will become less significant. This is expected to place more emphasis on transaction fees, which ensure miners are fairly compensated for maintaining the Bitcoin network. .

The $1 billion milestone, is just that, a notch in Bitcoin‘s history, but a positive one nonetheless.

Want more Hard Fork? Join us in Amsterdam on October 15-17 to discuss blockchain and cryptocurrency with leading experts.