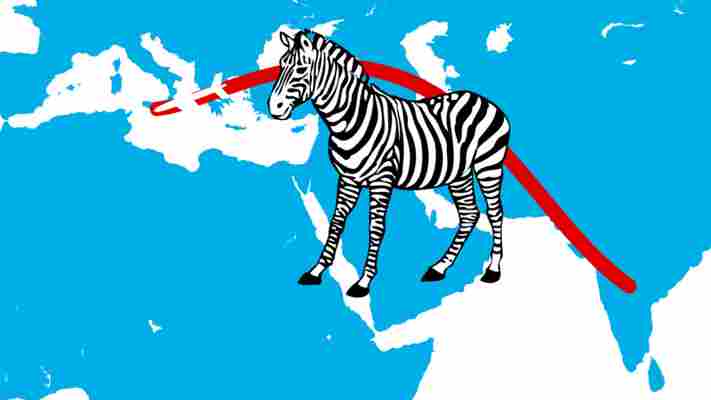

Zebpay , once India’s largest cryptocurrency exchange, is moving operations to Malta after having shut shop on its home turf last month.

The exchange, which currently supports 20 cryptocurrencies, will serve users in 20 countries across Europe:

Unfortunately, the exchange won’t be accessible to users in India.

The company had no choice but to leave India shores following strict regulations issued in April by India’s central banking institution, the Reserve Bank of India (RBI). At that time, the RBI directed banks to stop doing business with cryptocurrency firms .

Subsequently, Zebpay disabled Indian Rupee deposits and withdrawals , and eventually closed its exchange service entirely across the country towards the end of September.

That led to a loss of some three million investors in India for Zebpay – which, as Quartz noted , is roughly half the number of investors nationwide.

While India has refused to play nice with cryptocurrency exchanges – extending legal battles against the RBI’s directives in the Supreme Court by months and delaying regulations concerning domestic use and investment in cryptocurrencies – Malta warmly welcomes such businesses with more transparent rules governing how they can operate. Binance said in March that it planned to move operations to Malta after facing challenges setting up across Asia.

It’ll be interesting to see how Zebpay does in its new digs, as it now has to court a whole new market. Hopefully, the move will encourage India’s regulatory authorities to sit up and take notice, and move faster towards drafting guidelines that allow exchanges to begin functioning locally soon.

Indiegogo quietly canceled its first ICO after raising $5.2 million

Indiegogo’s first foray into the world of blockchain and cryptocurrency has gone awry – but the good thing is that it appears investors will at least get their money back.

In an email sent out in July, Indiegogo’s token brokerage partner, MicroVentures, informed investors they will not be receiving tokens – but refunds instead. From the looks of it, the reason for issuing refunds are recent changes in regulation.

Hard Fork has since obtained a copy of the message, which you can read below:

Not to be mistaken with yesterday’s security token offering for the rich , Indiegogo announced plans to branch out into initial coin offerings (ICOs) in a statement last December. Given its success (and some failures ) in the crowdraising sector, the expansion into token offerings seemed like a good fit.

The guinea pig was the Fan Controlled Football League (FCPL), an Indiegogo alum seeking to raise up to $5 million to build a community-run football league. In return, the company promised to distribute tokens to their investors. The token distribution was to be overseen by Indiegogo’s partner, MicroVentures.

The announcement gathered tons of attention from media outlets, securing coverage from Fortune , CNBC , CoinDesk , TechCrunch , and even The New York Times .

“ We want to bring a brand of trust to the entire industry, which we think will bring [ICOs] to the mainstream,” Indiegogo co-founder Slava Rubin told The New York Times in 2017. “ Now, we’re ready to become the go-to platform for selling and investing in digital tokens and blockchain-based assets, and we can’t wait for you to join us,” Indiegogo’s announcement added.

( Correction, August 24, 16:59 PM UTC: Due to a miscommunication, this piece initially suggested that Indiegogo’s standard five-percent fee on all funds raised applied to its token offerings too. This is incorrect, the fee does not apply to ICOs and security token offerings.We’ve since removed this reference and apologize for the mistake.)

Indeed, FCFL boasted about exceeding its crowdfunding goals, raising the equivalent of $5.2 million “in Bitcoin, Ethereum, and classic fiat currency.” Unfortunately, the tokens were never distributed to investors. In fact, it appears MicroVentures did not even consult with FCFL prior to informing investors about the botched token sale.

According to FCFL CEO Sohrob Farudi, MicroVentures initiated the refunding process without FCFL’s approval. (We contacted MicroVentures for a clarification, but representatives were not available for comment as of time of publishing.)

“ We would like to address the recent email that we understand some of you received from MicroVentures,” Farudi said in a July statement, referring to the refund message shared above. “We did not consent to that email being sent out. We have no way to communicate directly with the purchasers who participated in our presale [sic] on MicroVentures platform as MicroVentures has refused to give us any information about who the purchasers are in order for us to communicate with them.”

“ If you were a purchaser in the MicroVentures platform offering, FCFL would be happy to hear from you directly,” Farudi added. “We want to ensure that MicroVentures is handling this unwinding that it initiated properly and treating any purchasers in the MicroVentures platform offering fairly.”

For the record, other than the St Regis Aspen Resort security token offering from yesterday, FCFL is Indiegogo’s first and only experience in the blockchain funding space. Speaking to The Verge in August, Rubin said the FCFL token sale “ went well ” – despite MicroVenture’s intention to issue refunds.

Asked about what went wrong with the FCFL ICO, Rubin told Hard Fork “the [MicroVentures] email issued to investors provides all the context for the refund.”

“For clarification, Indiegogo partnered with MicroVentures in 2016, an SEC-registered [broker-dealer], to help market and amplify offerings on their platform to our global audience,” he further clarified in an email to Hard Fork. “Indiegogo itself is not a registered broker-dealer, and in the case of FCFL, or any other investment offering, does not participate in investment related activities.”

Meanwhile, Farudi insists FCFL is yet to be “ given a valid reason as to why MicroVentures cannot complete the offering.” Not exactly what one would call a smooth execution.

In all fairness, Indiegogo is hardly the only company to have back-pedalled on a scheduled token offering due to regulatory crackdowns . Indeed, tons of blockchain startups – including messaging giant Telegram – have had to abort their public token sales.

Binance will let you buy Bitcoin with cash from 1,300 stores in Australia

Binance says cryptocurrency fans in Australia will soon be able to purchase Bitcoin from over 1,300 supported Newsagents across the country.

The new service , “Binance Lite,” marks the first time the Malta-based exchange has managed to open a fiat gateway in Australia. While it will only support buying Bitcoin at launch, press materials say more digital currency and fiat options will be added in the future.

“Binance Lite Australia further expands digital currency adoption by providing easier ways to buy [Bitcoin],” said Wei Zhou, Binance CFO. “Australia has been at the forefront of blockchain innovation, and we hope Binance Lite Australia can play a role to help further this cause.”

Once users complete specialized account verification (read: Know-Your-Customer and Anti-Money-Laundering procedures) , Binance says users will be able to place an order online, deposit cash at their nearest Newsagent store, and then receive their Bitcoin “within minutes.”

Binance has opened other fiat gateways lately, too, albeit in other parts of the world. In January, it allowed credit card payments through its global exchange for the first time, and opened markets for Euros and British Points . It even started an exchange in Uganda that allows trade with Ugandan Shillings.

Really, Binance’s mission to allow Bitcoin fans to purchase cryptocurrency with cash, in person (after “ doxxing ” themselves), is awfully similar to what’s happening in France.

There, “tabacs” are slowly supporting cryptocurrency by installing machines that sell Bitcoin for a 7-percent fee. Binance Lite’s site currently suggests Aussies will pay a 5-percent fee for purchasing Bitcoin with cash, in store.

While Binance is trying hard to pitch this system as “ the easiest way to buy Bitcoin with cash in Australia,” it’s definitely not the most anonymous, and more than likely, not the cheapest.