In August 2017, the controversy over Bitcoin’s scalability issues led to its blockchain being split for the first time in history, resulting in its first hard fork — Bitcoin Cash (BCH).

Bitcoin Cash was a cryptocurrency with a purpose. Its proponents wanted a digital currency that would reduce high transaction fees associated with Bitcoin (BTC), making everyday use of cryptocurrencies viable. This was to be achieved by increasing the block size limits of Bitcoin’s blockchain from 1 MB to 8 MB (later to 32 MB).

Ever since its conception, Bitcoin Cash proponents have been clashing with Bitcoin proponents who favored SegWit and Lightning Network as better solutions to the apex cryptocurrency’s scalability problems rather than a hard fork.

This was until August 2018 when Bitcoin Cash got caught in a civil war, again over block size limits. The result was a split of Bitcoin Cash into two rivaling cryptocurrencies in November — Bitcoin ABC (backed by Roger Ver and Bitmain’s Jihan Wu) and Bitcoin SV (backed by Craig Wright) which would maintain block sizes of 32 MB and 128 MB respectively.

With the support of a majority of exchange desks, Bitcoin ABC became the new Bitcoin Cash (BCH) post the split, and Bitcoin SV became a separate cryptocurrency with the BSV ticker.

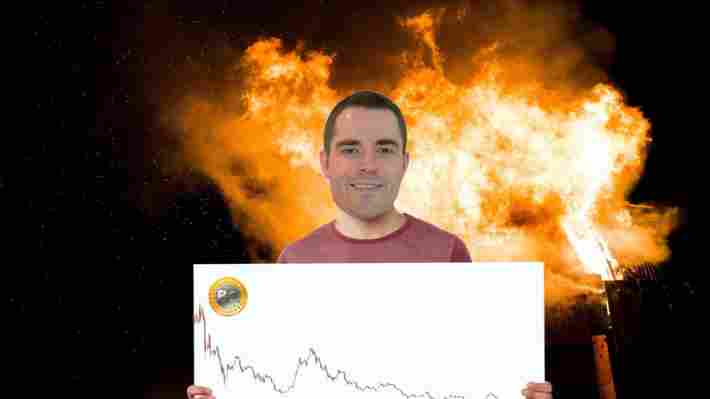

BCH/USD Performance Review

BCH opened for trading for the first time on August 1, 2017 at $ 294.60. By January 1, 2018, it was trading at $2,534.82 — a 760 percent increase! The overwhelming gain in price by early 2018 can be accredited to the “crypto boom” of November-December 2017 that saw prices of all cryptocurrencies rise.

BCH maintained some stability in its price for the first half of January consolidating around $2,500, with support and resistance levels around $2,800 and $2,400.

On January 16, BCH saw a sharp decline of 26 percent in market price falling to $1,772. This fall marked the beginning of the market-wide correction in cryptocurrency prices.

The market recovered briefly towards the end of April but saw continuous decline ever since until November 14, when BCH split into two cryptocurrencies.

BCH lost its market capitalization at a higher rate than BTC highlighting that the losses weren’t just a result of cryptocurrency market sentiments but also of individual performance.

BCH was worth 0.181 BTC at the start of the year but fell to 0.093 BTC by April. It made a recovery in the middle of May and regained the original price it began the year with. But the spike would last short, and BCH/BTC continued to drop through the rest of the year. By November 14, it was worth 0.077 BTC, a 57 percent drop since the beginning of the year.

A stark difference in market movements could be seen as a result of the hard fork on November 15.

BCH closed on $425.01 on November 14, and the two resultant cryptocurrencies were trading at $ 289 (BCH or Bitcoin ABC) and $ 96.50 ( BSV or Bitcoin SV) on November 15. This was a significant market loss for BCH as the two cryptocurrencies combined couldn’t make up to BCH’s market price the day before.

This is in contrast to BCH’s own split from BTC in 2017 when the price of the two cryptocurrencies combined was worth more than the price of BTC alone, resulting in a gain for BTC owners.

As of December first week, BSV is maintaining its price around $90, while BCH (ABC) has fallen further to the lowest ever at $125.

Taken together, they mark a 90 percent decrease in BCH price since the beginning of the year.

BCH — Major events in 2018

Bitcoin Cash had a decent start in 2018, having gotten listed on Coinbase’s cryptocurrency exchange desk GDAX in December 2017. The initial demand was so high — in comparison to sell orders being placed on the exchange — that Coinbase had to abruptly disable its trading, although insider trading was suspected.

Soon after, fear over crackdowns in China and South Korea took over the cryptocurrency market, and BCH couldn’t escape the fate either, effectively ending its bull run.

In February, decentralized marketplace OpenBazaar added support for BCH on its platform. In March, Goldman-Sachs backed Circle , Abra , and Grayscale Investments began offering BCH on their respective investment platforms.

The US-based financial services company Robinhood also started offering no-fee trading of BCH on its mobile app in July.

There were frequent clashes between the Bitcoin and Bitcoin Cash camps throughout the year, with members of cryptocurrency community picking sides.

The insistence of the Bitcoin Cash camp led by Roger Ver to refer to Bitcoin as “Bitcoin Core” was rejected by the cryptocurrency community and exchanges.

Further technical differences between the Bitcoin Cash developers hampered their united fight against Bitcoin.

In August, Bitcoin ABC announced a software upgrade for Bitcoin Cash with a smart contract feature to allow developers to build applications over its blockchain. This move was met with resistance led by self-proclaimed Bitcoin creator Craig Wright and cryptocurrency news website Coingeek, who launched their own Bitcoin Cash implementation called Bitcoin SV, with the aim of increasing scalability and transaction speeds.

The incompatibility of the two implementations ultimately resulted in a hard fork in November. The ensuing war over gaining computing power (hash) between the two offshoots has cost billions of dollars, according to Bloomberg.

What to expect in 2019

As of December 2018, neither of the off-shoots has managed to emerge as a clear winner in terms of the computing power they control. This war is likely to continue at least in the first quarter of 2019. The dominant coin will benefit from attracting more developers, miners, and investors, establishing itself as the main chain.

The former BCH didn’t prove effective in offering better transaction value than BTC, and its overall transaction volume remained significantly low. In the absence of proving actual utility in improving transaction efficiency, BCH (ABC) and BSV’s prospects aren’t looking good either.

The two coins will find it difficult to recover the market capitalization lost in 2018 due to the hard fork. If price movements in 2018 are any indication, both coins are at risk of further losing relative value to BTC in 2019.

Now that you have actionable information on the future of Bitcoin Cash , it’s time to start investing. With eToro , a leading social trading platform, you can trade manually or copy the actions taken by leading traders, taking much of the stress and work out of your investments.

We’re launching Hard Fork Decentralized, our first blockchain event

Earlier this year, we launched Hard Fork , a bespoke blockchain and crypto brand in cooperation with our friends at eToro . Hard Fork quickly became a trusted source for the blockchain and crypto space and is read by more than a million people each month.

In May, Hard Fork was an important part of TNW2018 , our yearly flagship event that brings together 15,000 professionals from all over the world to do business in Europe. The Hard Fork stage (you guessed it; powered by eToro) had room for 1,500 people and was packed throughout the event. It was a good start.

In the meantime, we continued to kick ass – breaking stories , hosting expert A M A ‘s and generally setting the record straight .

Even though the total market cap had drastically fallen and the sentiment in the market has been bearish over the last few months, Hard Fork has been showing continuous growth. The underlying technology is rapidly improving, use cases are popping up everywhere and the smartest brains in the world are moving their efforts and focus to the blockchain.

We probably haven’t seen the bottom yet, but blockchain is here to stay and will change the way we do business and the way we organize ourselves. At TNW, we truly believe in the space and we’re dedicated to double down on it and grow the Hard Fork community online and offline.

That’s why we’ve decided to develop a stand-alone Hard Fork event format. When crafting the format, we found some very powerful shared beliefs amongst all types of blockchain and cryptocurrency related companies.

First: decentralization will play a significant role in our near future and will impact people, businesses, and governments.

Second: everybody is dedicated to bringing the next 100 million people to the blockchain.

Those two shared beliefs plus the experience of hosting Europe’s leading (and awarded best B2B event of Europe

Razer wants you to mine cryptocurrency for store credit – don’t

Yesterday, Razer announced the launch of its SoftMiner program which uses a computer’s redundant resources to mine cryptocurrency when the user is “away from keyboard” (AFK). Only the user doesn’t get any of the mined cryptocurrency, all they get is store credit at Razer, known as Razer Silver.

When a person runs the SoftMiner program on their PC they are actually contributing to a third party platform called GammaNow, Motherboard reports. This third party is responsible for managing the mined cryptocurrency which will include Ether and a handful of other altcoins. GammaNow pays Razer a fee for all the cryptocurrency mined through the SoftMiner platform, some of which is passed on to the user.

Think about that for a second, there’s not one intermediary, but two; Razer and GammaNow. Obviously, GammaNow and Razer are both taking a cut of any profits made from the mined cryptocurrency, and the users return is likely to be greatly diminished.

Naturally Razer has come under great scrutiny for the release of this software. It seems particularly confusing given the recent downturn in the cryptocurrency market, and the fact that miners are reporting huge losses , and shutting down operations left right and center at the moment.

ZDnet crunched some numbers and found each piece of Razer silver is worth about $0.003, it would take a SoftMiner user three days, non-stop, to earn $5 worth of Razer Silver. Bear in mind Razer Silver is not a cryptocurrency, it can’t be traded and it can’t be transferred. And of course, this is all before any additional electricity costs are taken into consideration.

Razer aren’t the first to try and encourage users to mine cryptocurrency with their idle computers. Recently, hardware manufacturer ASUS launched a similar scheme to get its GPU owners to mine coins with their redundant graphics cards. This all comes at a time when ASUS and Gigabyte announced that they have swathes of surplus GPUs , I’m dubious as to whether these platforms were created to help shift some of that excess stock.

If you’re a massive fan of Razer hardware, and have cheap electricity maybe SoftMiner might work well for you. But for the majority of us, it’s likely to put excess wear on our computers and increase our electricity bills all for little reward. If you’re serious about mining, download something like MultiMiner and keep all the profits for yourself.