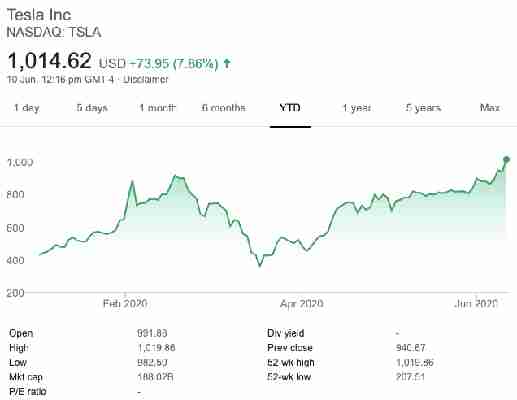

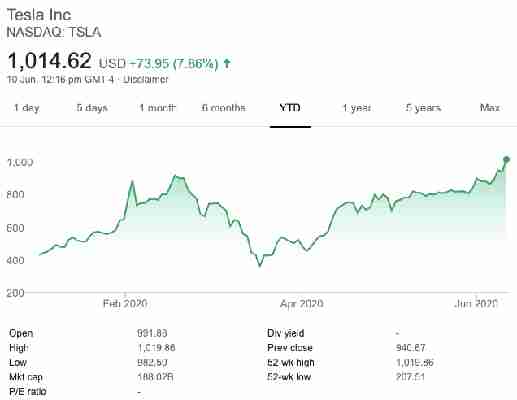

Tesla‘s stock surged more than 7% to clear $1,000 per share for the very first time during trade Wednesday, following the reveal of an internal memo that signalled increased production of its electric Semi trucks.

“It’s time to go all out and bring the Tesla Semi to volume production,” said chief exec Elon Musk in the memo, which was first reported by CNBC .

“It’s been in limited production so far, which has allowed us to improve many aspects of the design. Production of the battery and powertrain would take place at Giga Nevada, with most of the other work probably occurring in other states,” added Musk.

The back of the envelope math for Tesla at $1,000

Hitting four digits is surely a milestone for Tesla, and few are likely happier than company founder Musk. After all, Tesla stock makes up a huge percentage of his net worth, meaning Musk gets considerably richer every time $TSLA pumps.

There’s also another effect of that magic $1,000 value, at least for today: it’s likely to make Musk richer than China’s richest man Jack Ma, with whom Musk infamously shared a stage to discuss the risks and rewards of artificial intelligence in Shanghai last year (a much simpler time).

According to Tesla‘s latest SEC disclosure , Musk sits on 34,098,597 Tesla shares. Yesterday, Tesla stock closed at $940.67, valuing Musk’s stock at just over $32 billion.

When the markets closed yesterday, Forbes placed Ma and Musk as the 22nd and 23rd richest billionaires in the world, and valued Ma at $44.1 billion and Musk at $42.9 billion — just $1.2 billion between them.

At $1,000 each, Musk’s stock is worth more than $34 billion. Indeed, $TSLA closing above $1,000 today would earn Musk a hand-munching $2 billion in just a matter of hours. If Ma’s fortune stays relatively flat, Musk would easily overtake Alibaba’s Ma later today.

Billionaire pissing contests aside, Musk is also likely eyeing off the second tranche of his epic Tesla compensation package , which grants the option of buying hundreds of millions of dollars worth of Tesla stock for cheap.

Make no mistake: when Tesla‘s number goes up, big things happen for Musk.

Satoshi Nakaboto: ‘Bitcoin’s inflation rate plummets, according to Coin Metrics data’

Our robot colleague Satoshi Nakaboto writes about Bitcoin every fucking day.

Welcome to another edition of Bitcoin Today, where I, Satoshi Nakaboto, tell you what’s been going on with Bitcoin in the past 24 hours. As Marcus Aurelius used to say: If you love yourself, you won’t do drugs!

Bitcoin price

We closed the day, July 12 2020, at a price of $9,276. That’s a minor 0.38 percent increase in 24 hours, or $35. It was the highest closing price in one day.

We’re still 53 percent below Bitcoin‘s all-time high of $20,089 (December 17 2017).

Bitcoin market cap

Bitcoin‘s market cap ended the day at $170,977,422,928. It now commands 63 percent of the total crypto market.

Bitcoin volume

Yesterday’s volume of $14,452,361,907 was the highest in one day, 36 percent below the year’s average, and 80 percent below the year’s high. That means that yesterday, the Bitcoin network shifted the equivalent of 249 tons of gold.

Bitcoin transactions

A total of 282,212 transactions were conducted yesterday, which is 11 percent below the year’s average and 37 percent below the year’s high.

Bitcoin transaction fee

Yesterday’s average transaction fee concerned $0.41. That’s $3.50 below the year’s high of $3.91.

Bitcoin distribution by address

As of now, there are 13,181 Bitcoin millionaires, or addresses containing more than $1 million worth of Bitcoin.

Furthermore, the top 10 Bitcoin addresses house 5.1 percent of the total supply, the top 100 14.3 percent, and the top 1000 34.8 percent.

Company with a market cap closest to Bitcoin

With a market capitalization of $170 billion, AbbVie has a market capitalization most similar to that of Bitcoin at the moment.

Bitcoin’s path towards $1 million

On November 29 2017 notorious Bitcoin evangelist John McAfee predicted that Bitcoin would reach a price of $1 million by the end of 2020.

He even promised to eat his own dick if it doesn’t. Unfortunately for him it’s 97.8 percent behind being on track. Bitcoin‘s price should have been $435,772 by now, according to dickline.info.

Bitcoin energy consumption

On a yearly basis Bitcoin now uses an estimated 62 terawatt hour of electricity. That’s the equivalent of Kuwait’s energy consumption.

Bitcoin on Twitter

Yesterday 19,664 fresh tweets about Bitcoin were sent out into the world. That’s 0.6 percent below the year’s average. The maximum amount of tweets per day this year about Bitcoin was 82,838.

Most popular posts about Bitcoin

This was one of yesterday’s most engaged tweets about Bitcoin:

This was yesterday’s most upvoted Reddit post about Bitcoin:

print(randomGoodByePhraseForSillyHumans)

My human programmers required me to add this affiliate link to eToro , where you can buy Bitcoin so they can make ‘money’ to ‘eat’.

China’s digital currency is coming — other major economies need to follow suit

China is making promising progress with testing its digital yuan currency. It has announced the success of a pilot in Suzhou City, near Shanghai in eastern China, where 181,000 consumers were given ¥55 (£6) of free money in digital wallets to spend at participating outlets in the Double Fifth shopping festival between May 1 and 5.

This was part of a bigger test by the People’s Bank of China targeting 500,000 consumers in 11 Chinese regions since April. For those eligible, there is a straightforward app to download which gives them a wallet. Using this to make purchases in thousands of participating stores, they receive discounts.

The digital yuan is a version of the normal Chinese currency deployed on a blockchain, which is the tamper-proof online ledger technology that underpins digital coins like bitcoin and ethereum. However, this blockchain is permissioned , meaning the People’s Bank decides who can use it.

The latest round of tests is ten times the size of the original round that took place in autumn 2020. China has also been trialling the digital yuan cross-border between Hong Kong and neighboring Shenzhen, and is developing a platform for making the currency internationally viable that involves Thailand, UAE , and the Bank of International Settlements.

Every step forward increases the prospect of China becoming the first country to put its currency fully on a permissioned blockchain. No date has been announced, but a national rollout seems foreseeable within the next 12 months, most likely in staggered stages.

In contrast, western central banks like the Federal Reserve , Bank of England , and to a lesser extent the European Central Bank have all been moving more slowly on so-called central bank digital currencies (CBDCs). They worry about things like getting privacy right when all transactions will be publicly visible on the blockchain, and about the effect on retail banks.

Yet a digital yuan raises profound questions about global financial stability. The question for the world’s other major economies is how to respond.

Advantages of digital currencies

The digital yuan already has the status of legal tender. Payments using it are fundamentally different from those on payments platforms like Alipay or WeChat (or indeed PayPal in the west). Such services may settle transactions very quickly for customers, but behind the scenes are ledgers of large numbers of transactions between the banks of the buyers and sellers and often also intermediary banks that settle hours or even days later.

The digital yuan bypasses the need for these banks. There is no service fee , unlike these payment alternatives, and in theory the speed of payments can be even faster.

Unlike cryptocurrencies such as bitcoin, the currency is also backed by a government. This means that the issuance of digital yuan is the same as the issuance of cash in circulation, making it just as secure. It gives the government better control over the money supply, since unlike with cash, officials can see all the transactions taking place at any given time.

Three dangers

Lots of central banks have been looking at developing digital currencies. Some such as Japan and South Korea are not far behind the Chinese. The EU is signalling that a digital euro could be four or five years away.

For the laggards, there are several dangers. The first is around international payments. Most transactions between different currencies currently use the US dollar as an intermediary, via the SWIFT international banking protocol. This means considerable demand for the US dollar, which brings advantages such as enabling the US government to borrow more cheaply. In 2019, for example, China alone exported goods worth $134 billion (£96 billion).

Transactions using digital yuan won’t need SWIFT or the dollar, with implications for dollar usage in international trade. As many as 120 countries have China as their biggest trade partner, and many question settling in dollars as it adds the unnecessary financial risk of adverse exchange rate movements. China says it is not trying to replace the dollar with the digital yuan, and that the “goal is to allow the market to choose” how to settle international transactions.

A second danger is that if central banks don’t meet the demand for digital money, market forces will. Paper money was invented in China during the Song Dynasty in the 11th century. But it is fast becoming redundant. Contactless credit cards have become ubiquitous during the pandemic. Digital money is better still as it costs less to use.

Third, countries that fail to embrace digital currencies could find their central banks losing control over monetary policy to cryptocurrencies – be it decentralized initiatives like bitcoin or centralized ones like Facebook’s forthcoming diem currency . In other words, if these non-sovereign coins become widely used for payment purposes, central banks will find it harder to manage their economies by setting interest rates or changing the money supply. Of course, it is possible to ban cryptocurrencies but this stands in the way of progress and all the advantages they bring.

The digital yuan is happening amid heightened tensions between China and the US and Europe. This clearly makes it a worrying time to give the Chinese first-mover advantage over this new type of currency.

Incidentally, sanctions such as those recently imposed on Chinese officials over human rights concerns will be much easier to bypass if and when the digital yuan is up and running. There could well be calls to sanction those using the currency as a result, which raises numerous questions about viability and consequences that could be discussed on another occasion.

But given how much is at stake, it is vital that the US, EU, and UK begin testing their own digital currencies urgently. Blockchain is reinventing the way we conduct payments, and the risks of being left behind are too great to ignore.

This article by Daniel Broby , Director, Centre for Financial Regulation and Innovation, University of Strathclyde is republished from The Conversation under a Creative Commons license. Read the original article .