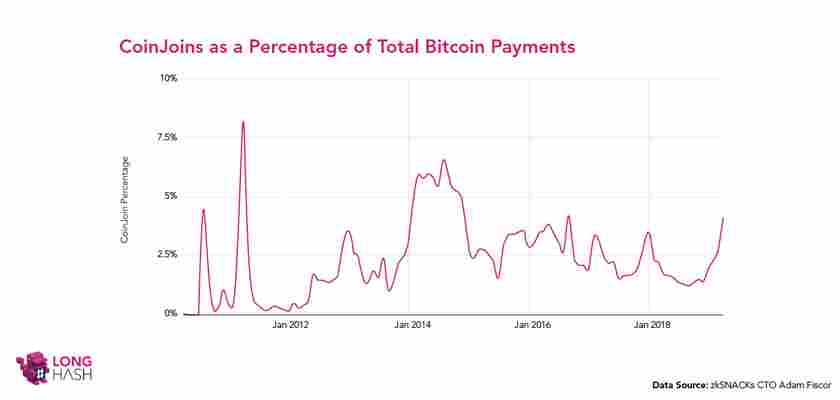

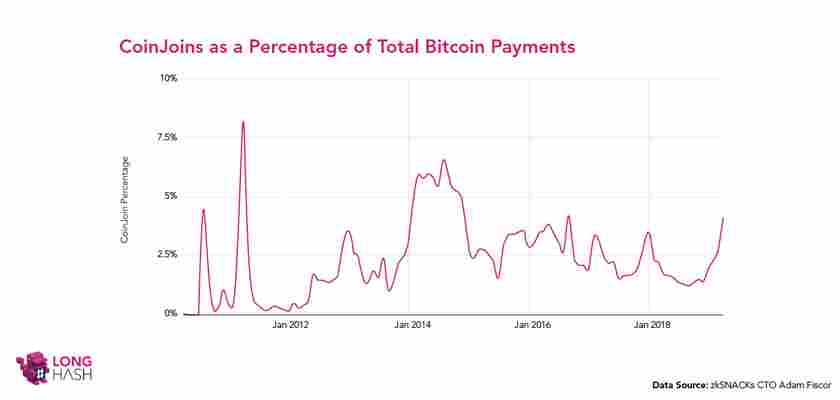

Bitcoiners are using cryptocurrency mixers three times more often than they were nine months ago.

Mixed cryptocurrency transactions – or CoinJoins – now account for over 4 percent of all Bitcoin transactions, according to a report from blockchain data firm Long Hash .

CoinJoin or mixing services group many transactions together before sending the correct amounts to their final destinations. In doing so, it attempts to obscure the connection between the sender and recipient in each transaction.

When measured against the total monthly Bitcoin transactions, the number of CoinJoin transactions over the past 30 days is three times the volume it was in August 2018.

CoinJoin transactions are also at their highest point since late 2013 and early 2014. That said, overall Bitcoin transaction volumes were much lower five years ago. LongHash suggests the 2013/2014 highs were a result of high developer activity and CoinJoin being implemented in the popular Blockchainom wallet.

Indeed, lower transaction volumes also means lower fees which makes using cryptocurrency mixing services more cost-effective. Transaction fees are three times now what they were five years ago .

LongHash identified CoinJoin transactions using two criteria. “[First] the transaction has at least two outputs of equal value and [second] the value of the outputs is less than or equal to the value of the inputs,” the report reads.

Bitcoin is often thought to be private thanks to its pseudonymity, but it’s often not as private as many people think, as two drug dealers recently found out .

However, CoinJoins aren’t always as private or secure as they sound . Security experts have previously warned that these systems only really obscure transactions from unskilled blockchain researchers .

Did you know? Hard Fork has its own stage at TNW2019 , our tech conference in Amsterdam. Check it out .

The controversies of blockchain governance and rough consensus

Welcome to Hard Fork Basics, a collection of tips, tricks, guides, and advice to keep you up to date in the cryptocurrency and blockchain world.

The governance of blockchains is one of the most fascinating, contentious , and difficult topics to master, but it’s one we must try to understand as the network’s ability to adapt, and the extent to which it may be able to do so, will be crucial for its future.

When it comes to blockchain technology , the notion of governance is closely tied to the incentives or economics on which the network is based on. Governance also has a direct impact on how transactions will be processed.

In this article, Hard Fork is going to look at on-chain governance, what it is, how it works, and why it’s necessary.

What is it?

On-chain governance describes the manner of proposing changes to a cryptocurrency and its underlying blockchain by a certain set of processes, rather than a simple majority consensus.

The core differences between blockchains can be highlighted by examining exactly how these decisions are made, and by whom. To understand the concept, it’s important to identify all the participants in the network and how they work together.

Miners are a core component in a decentralized public blockchain network because they help sustain it. They are incentivized by transaction fees and block rewards.

Developers create the protocol and maintain the blockchain. They are also responsible for enforcing changes such as hard or soft forks . Like miners, developers are also incentivized to keep the network going.

When developers propose a change to the network, a core group is tasked with achieving consensus over whether to accept or reject them. For miners, they back changes by contributing their hash power to one of the blockchains borne from a hard fork. Developers choose which blockchain is suitable for their app, and users (hopefully) adopt the most effective solutions.

For blockchains like Bitcoin, this creates an interesting dynamic. Mostly, the network relies on what is called “ rough consensus ” – changes are proposed as software updates and its the whole ecosystem that eventually decides which updates to adopt in a “natural” way.

OK, so how is on-chain governance different?

The basic premise is simple. Imagine I am a developer, and along with a group of other developers, I want to make an improvement to the blockchain. In an on-chain governance system, I’ll propose the change and nodes will vote to either implement or reject it.

However, it’s important to note that not all nodes have the same voting power – those with more coins will have more votes. Once the change is accepted, it gets included in the blockchain and is baselined.

The way in which on-chain governance works depends on the blockchain. Tezos, for example, is a cryptocurrency based on a self-amending ledger, meaning that proposed updates are implemented on its blockchain and rolled out on to a test version of the chain.

If the changes are successful they are completed on a production version of the blockchain. If not, they are rolled back.

The advantages

First and foremost, supporters of the on-chain governance system would argue it’s a decentralized form of governance.

They’d say so because changes to a blockchain are not decided by a core development community, instead, each node (and commonly, each token holder) is given voting power.

On-chain governance systems are also typically characterized by quicker turnaround times as consensus is achieved a lot faster.

The possibility of a hard fork (a permanent change in the ledger’s code) is reduced significantly as every single proposed change must be signed off by all nodes, which receive economic incentives to vote.

The disadvantages

As is the case with most democracies, voting turnout can be low in an on-chain governance system. This can pose a danger to the system as low-voter turnout could mean a single node, with a significant amount of coins, could manipulate the protocol’s future direction .

As previously mentioned, nodes with more coins, will get more votes, meaning users with higher stakes can potentially control the voting process. This is supposed to take control away from miners and developers, and shift it towards investors and users.

Criticism

Off-chain governance has been criticized by opponents, who argue that the system is in actual fact centralized among developers and miners. Critics usually refer to two well-known forks.

The first is a split of Ethereum’s original blockchain into Ethereum Classic and Ethereum back in 2016, which took place despite another soft fork proposal. News reports at the time suggested that the majority of the Ethereum community supported the soft fork, but a core group of developers decided to implement a hard fork instead.

Some members of the community have claimed this goes against the “ Code is Law ” principle, which establishes that a piece of software’s governing parameters are set out in the original code.

The emergence of Bitcoin Cash in 2017 is alsoused by proponents of on-chain governance to highlight that rough governance doesn’t work. During the fork that eventually paved the way for the new cryptocurrency, Bitcoin’s core development team rejected the proposal to increase its average block size. They did so despite being faced with rising transaction fees, which had rendered it barely usable for daily transactions .

Having said this, if all systems shifted towards on-chain governance, we may find ourselves left with a loose definition of “blockchain,” as exemplified by recent research which ultimately described the popular EOS blockchain as something more akin to a glorified cloud computing service.

Bitcoin scammers net nearly $1M by telling people they can see them masturbate

A new kind of scam has accrued almost $1 million in bitcoin from frightened porn viewers, says a new report — and they’re staining the good names of Shakespeare and Austen to do it.

According to the report , from cybersecurity firm Area 1, this scam involves a threatening email, in which the victim is told videos or pictures of them watching pornography will be leaked to their contacts, along with whatever they were watching, unless they pay a ransom in Bitcoin. That hits some soft spots, so I can see why it works — threatening to expose intimate images and porn preferences is a double whammy.

Needless to say, it’s fake — they don’t actually have such videos of the victim, but are hoping to scare them into paying up. It’s not exactly new that scammers try to use language that will trigger fear — a quick look at the spam folder on my work email shows things like “Trying to Reach You,” and “Reply Urgent.” But in this case the sad part is that it works. According to Area 1’s report, the scammers have earned $949,000 from this, as the blockchain record associated with their digital wallet shows.

Possibly the most disgusting part of this, at least to me, is that the scammers apparently have found a way of getting emails past spam filters by “[pasting] lines from Shakespeare or Jane Austen in invisible text in the email.” The idea that they’re using the language of two of the greatest writers in the world to worm their way into inboxes makes me want to break something.

According to Fortune , one of the tactics the authors of these scam letters apparently use to get you is showing you a password you’ve used at some point. PCMag also showed what one of these emails looked like: essentially it claims to have accessed your computer and contacts via “keylogger” and “remote desktop.” But if you’ve ever been part of a large-scale security breach on a website (basically, if you’ve ever been on Facebook), then you’ve likely had a password exposed at some point. That’s where they got it, most likely, but they’re hoping this extra bit of personal information will convince you they do, in fact, have access to your computer.

So, just to make sure we’re all the same page here: if you get one of these emails, don’t pay. And, to make absolutely sure you know they don’t have those images of you, cover your webcam unless you’re actively using it. You could get a fancy cover from Amazon if you want to be extra, but even if you don’t, tape is cheap and effective. Tape is your friend.

via Fortune