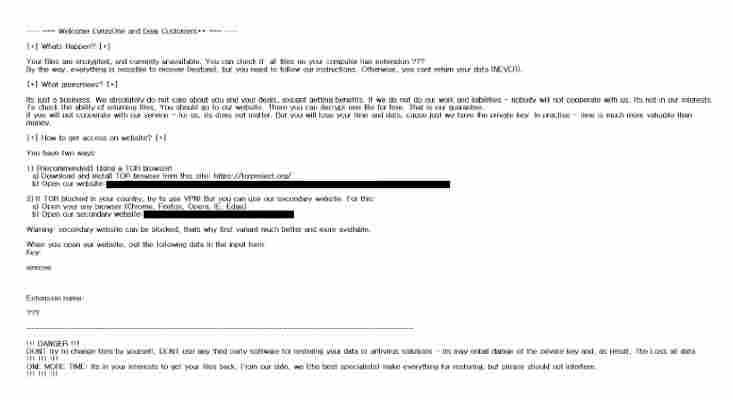

There’s no doubt that tech’s biggest companies have bounced hard since COVID-19 laid waste to global stock markets, but none have bounced quite as spectacularly as Tesla.

Still, even after removing Tesla as an outlier, a dozen companies in the tech-heavy NASDAQ 100 (NDX) have seen their share prices more than double since the index’s 2020 low on March 23.

[

That list includes the “Argentinian Alibaba” Mercadolibre, up an eye-twitching 166% since the NDX’s COVID crash, and fintech giant PayPal, which has bounced from $85.26 all the way to $198.18 in just five months.

Not quite as big as Tesla‘s 360% recovery, but still remarkable.

Chipset prince NVIDIA , online market lord eBay, orthodontic play Align Technology, and activewear incumbent Lululemon all staged remarkable comebacks too, up 128%, 118%, 115%, and 112% respectively.

The only plausible explanation for the latter pair being the importance of looking good for Insta during lockdown.

As it turns out, they all bounced harder than Apple. The maker of the iPhone has only managed a disrespectful 111% since NDX’s lowest point this year, but nonetheless contributed to sending the NDX to record highs this year, despite… global chaos.

But in terms of market values, no NDX company has added more dollars to their capitalizations than the Cupertino giant.

Apple was worth $959 million on March 23, and now it’s worth more than $2 trillion — the largest company in the US, tech or otherwise.

This means Apple‘s COVID-19 bounce is now valued in excess of $1 trillion.

[

But again, it’s Tesla that stands out. The visualization above shows the value added to each NDX constituent since March 23 — the bigger the bubble, the more value added since the bottom.

Check out Elon Musk’s electric vehicle wunderstock: Tesla added $169.5 billion to its market value post-COVID, and sits prominently amongst Alphabet, Facebook, NetEase, NVIDIA, and PayPal.

(NB: If the visualization doesn’t show, try reloading this page in your browser’s “Desktop Mode.”)

Hard Fork found just two NDX companies yet to recover from March 23’s COVID crash: pharma stocks Gilead and Walgreen Boots Alliance, respectively down 4% and 8% since their individual lows on that day.

In any case, the NDX overall is up 30% for the year.

What’s the opposite of a dead cat bounce ?

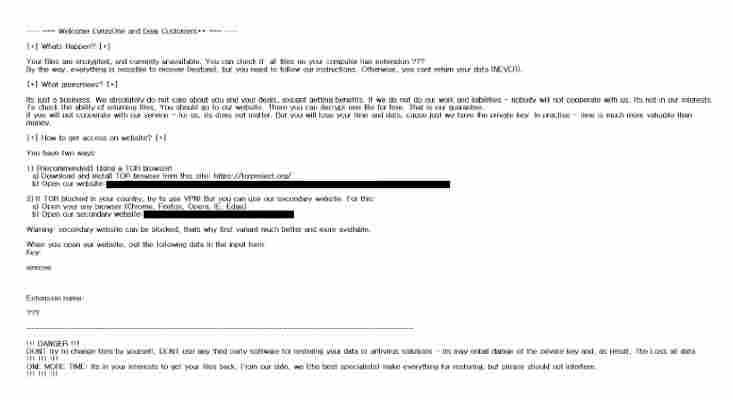

Bitcoin-hungry hackers ‘target major US data center firm’ with ransomware

A prominent data center provider in the US has reportedly been hit by the Sodinokibi ransomware, which several months ago earned a hacker $287,000 worth of Bitcoin in just three days.

According to ZDNet , CyrusOne is working with law enforcement and forensic firms to analyze the attack . The company is also assisting customers to restore the lost data .

CyrusOne is yet to disclose the attack. ZDNet reached out to CyrusOne but says a spokesperson was not available for comment at press time.

Sodinokibi: What we know

Sodinokibi has been doing the rounds in recent months.

Back in June, it attacked at least three managed service providers.

Then, in August it targeted local government authorities in Texas. At the time, attackers requested a collective ransom of $2.5 million, but victims refused to pay .

Several weeks later, it was the turn of several hundred dentist surgeries in the US .

World’s top companies, including Apple, borrowed $1 trillion in just five months

Apple and Disney are among a swathe of world-leading companies to have collectively borrowed $1 trillion to weather the effects of the coronavirus (COVID-19) pandemic — cash raised in just five months.

Software giant Oracle, aircraft manufacturer Boeing, and telecoms giant AT&T have borrowed the most ; they’ve issued corporate bonds worth $25 billion, $20 billion, and $12.5 billion respectively in 2020, reports the Financial Times citing data gathered by Refinitiv.

In fact, investment-grade companies in the US are issuing bonds much faster than in recent years, having raised $504 billion over the same period in 2019. Over the past half-decade, they’ve sold $1.3 trillion in bonds per year, on average.

Companies have been consistent in their borrowing, too. They issued more than $200 billion in corporate bonds for three consecutive months leading into May, which FT noted is the first time that’s happened since 1990.

The Fed made raising billions with bonds super cheap for big companies

Corporate bonds are essentially “IOUs,” a company borrows money from investors in return for special coupons, paying interest over a set period of time until the debt is returned to buyers in full.

But borrowing a trillion dollars has rarely been cheaper for the world’s biggest companies, as the Federal Reserve slashed borrowing costs when it reduced its target interest rate to between zero and 0.25%.

However, those measures have affected the “yield” tied to investment-grade bonds like the ones issued by Apple and Oracle. At the start of 2020 (before COVID-19 struck), buyers of corporate bonds would’ve received 2.9% returns. Now, they’re reportedly likely to net 2.6% on average.

Apple took advantage of this when it raised $8.5 billion earlier this year by selling four different bonds, with lifespans ranging from three to 30 years. The three-year and five-year versions came with 0.75% and 1.125% interest respectively, the lowest rates on such bonds since 2013. The iPhone-maker said it would use the funds to pay out dividends and buy-back its own shares.

As for exactly who will continue fronting cash for the likes of AT&T and Boeing, experts reportedly reckon the US central bank will be next in line, having already invested $1.8 billion with exchange-traded funds exposed to their debt.

I guess the Fed’s money printer still goes brrr .